The innovative solution to find Hostesses, Promoters, Stewards, Models, Waiters, Bartenders, DJs and other Professionals throughout ITALY for Fairs, Promotions, Congresses and Events.

Organizing an event has never been easier.

Find

For your Events, Quickly

No sooner said than done!

The ideal solution for those who want to totally delegate the search for the staff necessary for an event.

Wide choice

With +30,000 Professionals throughout Italy, ToGet4U is the only Partner you need for your Events.

Customer support

An Event Manager dedicated to you, always by your side to give you support for all your needs.

100% deductible

The invoice for our service is fully deductible for both IRES and IRAP purposes.

Brand & Partners

Your Operating Partner

Staff and Services for your Event

-

Write your request

Indicate the Professionals or Services you are looking for, in which City and Period.

-

We develop the Proposal

In a short time you will receive the profiles of the Professionals and the solutions for the management of your Event.

-

Compare and Choose

Because with ToGet4U® you choose the Staff and We will take care of your Event.

Services

For Staff

-

Create your Professional Profile

Insert your photos, your past experiences and all the information to impress organizers and entrepreneurs looking for staff.

-

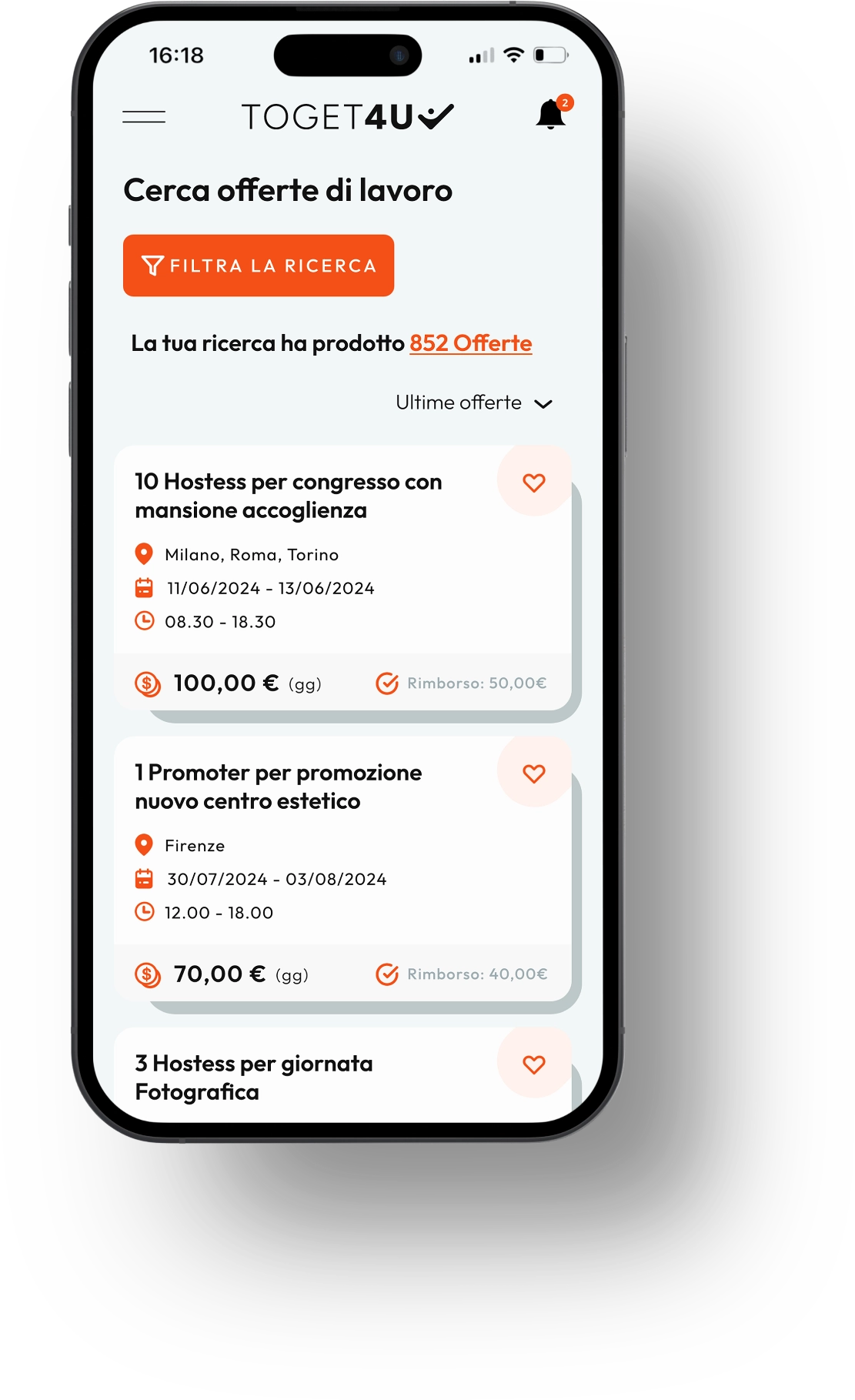

Apply for Job Offers

In total autonomy and freedom you can apply to the proposals of your interest and in line with what you are looking for.

-

Work and play!

If you are selected, sign the contract and honor the commitment made by providing your professionalism at its best!

About us

What our customers say

Read the opinions of those who have collaborated with us,

both as a customer and as a staff (source: Google)

Frequently Asked Questions

-

How does the service work for companies, entrepreneurs, and anyone looking for event staff?

Write your request indicating WHAT POSITIONS (hostesses, promoters, interpreters, etc.) you are looking for, in which CITY, and on which DAYS.

We will provide you with an all-inclusive quote for the organization and management of your event.

If you accept, we will start searching our portal to find the staff best suited to your needs. The professionals available for your event will apply, and we will send you their profiles.

YOU will choose the professionals for your event.

What’s more, with ToGet4U, you will always have access to a dashboard with all past and current information and an event manager who is always at your disposal. -

I would like to know the work regulations for hostesses, promoters, and stewards.

Labor regulations provide for various possibilities for classifying employees, based on the characteristics and duration of the work to be performed.

For example, to work as a steward in stadiums or as a sales assistant in a shop, it is necessary to use an employment contract (e.g., fixed-term or intermittent), while for other jobs where the task can be performed completely independently (e.g., translation/interpreting or stand management and promotions), a self-employment contract (occasional or otherwise) may be used.

In other cases, such as waiters, where there is no autonomy in the performance of the services, an occasional subordinate contract must be used, with payment by vouchers.Therefore, there is no single type of classification, but it will be necessary to assess the correct classification to be adopted for each individual event.

Below is an article taken from FISCOMANIA: This means that working as a hostess or promoter effectively means being self-employed. From a tax perspective, it is necessary to distinguish between those who carry out professional activities on a self-employed basis on a regular and continuous basis and those who only carry out such activities on an “occasional” basis. This distinction is fundamental, as we will see below, for the correct application of tax legislation.

Hostesses and promoters: occasional work

Hostess and promoter work is usually carried out through communication agencies, which pay the young people who offer their services for this work directly. The various agencies tend to use the formula of so-called “occasional services” to regulate the payment of hostess and promoter activities carried out by young people. This methodology is linked to the fact that the activity carried out is purely “occasional,” otherwise it could not be used.

The only regulation that governs occasional activities from a civil law perspective is that referred to in Article 2222 of the Civil Code (concerning the contract for services).

Occasional nature of the service

A worker who performs an occasional service can be defined as someone who undertakes to perform, in return for payment, a task or service mainly using their own labor, without being subject to subordination or coordination by the client, and on an entirely occasional basis. When hostess or promoter activities are carried out on a non-continuous basis, it is possible to use the Occasional Service to regulate the compensation between the agency and the hostess.

The occasional service is a tax regulation aimed at regulating activities that are not carried out on a continuous basis, i.e., occasional activities. To determine when an activity is occasional, reference must be made to how many times the activity was carried out during the year.

If the activity was carried out once or twice a year, the Occasional Service can be applied, but if, for example, the activity was carried out for several days during the year (either for a single agency or for different agencies), it is necessary to operate professionally with a VAT number.

–

For more information, visit the FISCOMANIA page — HERE -

Is the service free for those looking for a job as an event staff?

Yes, the service is absolutely FREE.

-

Do I need to send you my resume to work with you?

No, you do not need to send a resume. Go to the REGISTER section and follow the instructions to create your profile, uploading photos that meet the requirements (face and full body shot, preferably with a neutral background + other photos of your choice) and providing all the requested information (personal details, physical characteristics, and past experience) in the most professional manner possible.

You must also indicate the services you offer by choosing from those available (hostess, promoter, steward, DJ, bartender, etc.) and the cities/provinces where you are available (i.e., where you want to work, without needing reimbursement for expenses).

You will then receive email notifications only for offers that match your profile. Therefore, create the best professional profile that highlights your qualities and increases your chances of being selected by us and our clients to collaborate in the world of EVENTS. -

I just registered but I can’t access my profile. Why is that?

If you have just registered and cannot access your profile, you probably have not confirmed your activation via the link you received by email when you registered. If you cannot find the activation email, check your SPAM folder or other folders such as Promotions or Social (Gmail in particular applies this type of filter).

Look for the email with the subject line: Activate your account. Sender: info@toget4u.com.

Inside, there is a link to click on. If it is not clickable (due to filters in your mailbox), copy it correctly and paste it into a browser page, and the profile will be activated. -

How do job offers work?

After Registration, enter your reserved area from Login, in the Job Offers section and you will find the published job offers to which you can apply without limits but based on your real availability (do not apply to proposals too far from where you normally reside).

In case of selection by the customer, you will receive a Confirmation email with instructions and you will also be contacted by us via WhatsApp. You will have 24/48 hours to confirm your application and the Contract that you will find in the Contracts section of your user area, with all the contractual conditions.In case of doubt, in each Job Offer you will find the email of the contact person (to whom you can write your questions) and also the number of people already confirmed for the event.

Do not contact the contact person to ask if you have been selected: if this happens, he will contact you. Also because in 95% of cases it is the customer who chooses the professionals with whom he wants to collaborate.

You will receive by email the Job Offers only in the Provinces indicated in your Profile and in line with the services you propose. -

When do PAYMENTS take place?

Payments for the work carried out are made in the following periods:

– by 15 March for all works carried out and completed between 1 January and 28 February.

– by 15 May for all works carried out and completed between 1 March and 30 April.

– by 15 July for all works carried out and completed between 1 May and 30 June.

– by 15 September for all works carried out and completed between 1 July and 31 August.

– by 15 November for all works carried out and completed between 1 September and 31 October.

– by 12 January (of the following year) for all works carried out and completed between 1 November and 31 December.

–

These conditions are only valid if you work as an occasional self-employed contributor. For VAT holders and employees, on the other hand, payment will be made according to the conditions established from time to time.

In the BALANCE section we will update the fees accrued in the previous 2 months at the end of the two-month period.

Payments are made automatically with the timing indicated above to the bank details indicated on the BALANCE page.

Check your data carefully, both tax (name, surname, tax code, date and place of birth) and bank.

–

It is possible to request the advance payment of the fees accrued at any time (but not before 5 working days from the end of the event) at a cost of € 25 – which will be deducted from the net compensation – by sending an email to info@toget4u.com.

During the standard payment phase of the two-month works, advance payments may be delayed. -

What is the difference between VAT number and withholding tax?

The fees indicated in the Job Offers are always gross. Because that is the cost that we incur as a company.

The taxation applied depends on your tax regime, i.e. as:

– holder of a VAT number-

occasional self-employed worker (subject to withholding tax)

– worker hired according to the different types described above.

In case of a VAT number, we will pay you the gross compensation indicated + VAT (if applied) and you will then have to pay taxes according to your tax regime. If you have a VAT number in the flat-rate regime, you will pay only 15% tax (reduced to 5% for the first 5 years of activity) on income subject to substitute tax.

If you operate as an occasional self-employed worker, subject to withholding tax, we will have to advance the taxes for you and therefore 20% of the gross compensation will be paid to the Treasury as withholding tax, otherwise you may (and may) be subject to penalties by the tax authorities.

In the tax return, the withholding tax will be counted and considered in the settlement of taxes.

If you operate as an employee, taxation will depend on your personal status and therefore it will be impossible to calculate the net impact exactly, given the subjective legal status that can vary considerably from one subject to another (e.g. due to the right to deductions, municipal surcharges differentiated from municipality to municipality, etc.), although we will try to give you an estimate of the net amount, absolutely non-binding.EXAMPLE: let’s assume an offered compensation of € 100 + VAT.

A) If you have a VAT number, you will receive € 100 (+ 22% VAT if you are subject to VAT). Then we will pay you 122 €. Then it will be up to you to pay VAT and taxes.

B) If, on the other hand, you issue a receipt as occasional work (with withholding tax) you will receive 80% of the gross amount suffered, so €80. 20% of the compensation (therefore €20) will be paid to the State as withholding tax (potentially recoverable the following year in the declaration).

C) In the event of hiring as an employee, on the € 100 gross included in the payslip, you will be deducted the taxes (IRPEF and various contributions) to be paid to the State (with percentages that may vary according to your total income) and which will contribute to your personal pension. -

What happens if I can no longer fulfill the contract?

A signed contract represents a commercial agreement between a principal and an employee, with obligations and duties on both sides. When two parties sign a contract, it has the force of law, which means that those who do not respect its content risk suffering a lawsuit and having to pay damages to the other party. This is particularly the case if the time, place and manner established in the contract are not respected.

If the termination of the contract takes place within 24 hours of the Approval, unless ad hoc costs have already been advanced for you (e.g. airline tickets, train, hotels, uniforms of your size, nominal passes) there will be no consequences, despite the fact that damage is being created to Us and to the customer. In the case of named or tailor-made purchases, you may be asked for a reimbursement of expenses.

If the contract is terminated after 24 hours of Approval, you may incur a small claim for damages for breach of contract. The damage may vary from the amount of notice and the type/duration of the event. Each case will be evaluated on its own based on the severity of the case, the behavior of the resource, the mode of communication and also the number of resources employed in the activity.

In the event of interruption of the service during its performance, the company will decide whether to proceed:

(1) to the pro-rata payment of the activity,

(2) to a simple daily reimbursement of expenses of 30 €

(3) to no payment.

Also in this case, it will be necessary to evaluate the methods of communicating one’s absence and/or the damage caused to the company/customer.

So when you apply and approve a job (on ToGet4U the approval/signing of the contract is digital), it is very important to be sure that you can attend, because your absence could cause economic damage to the customer and also to us, who have worked to ensure that you could have a job opportunity and that now you are not respecting, also taking away the job opportunity from another person.

Therefore we always require maximum professionalism. No one forces you to apply and take a job, but if you do, then try to be responsible until the end.

Thank you for your efforts. -

How can I delete my Profile?

If for any reason you wish to delete your Profile, you can request cancellation from the DPO by sending an email to info@toget4u.com and within 15 days we will proceed with the cancellation, unless there are payments to you to be settled. In this case, the time may be longer and the cancellation may take place after the payment has been processed.

Contact us to receive a quote and proposals.